Browsing the Seas of Riches: Offshore Trust Fund Providers as the Ultimate Device for Financial Freedom and Property Defense

Are you looking for financial liberty and robust possession defense? Look no more than offshore trust solutions. In this post, we will direct you via the intricacies of browsing the seas of wealth. Discover the utmost device that offshore depend on services attend to your financial well-being. Uncover the advantages of offshore trust funds and discover crucial methods to take full advantage of property protection. Gain insights right into the regulatory and legal landscape, and explore tips and best practices for successfully taking care of offshore counts on.

The Function of Offshore Trust Solutions in Riches Administration

Offshore trust fund solutions play a critical function in wide range monitoring by giving unequaled property security and economic freedom. By establishing an offshore count on, you can safeguard your possessions from potential risks and unpredictabilities.

One of the essential benefits of offshore trust solutions is the degree of personal privacy they provide. By setting up a rely on a territory that offers stringent privacy legislations, you can ensure that your financial events continue to be exclusive and protected. This can be particularly valuable for individuals that value their privacy and intend to secure their riches from prying eyes.

Along with property security and privacy, offshore trusts also use considerable tax advantages. By developing a rely on a territory with favorable tax regulations, you can decrease your tax obligation obligations and maximize your wide range. This can potentially result in significant financial savings and higher financial flexibility.

Recognizing the Perks of Offshore Depends On for Financial Flexibility

Discover the benefits that offshore trust funds supply you when it comes to attaining economic independence and guarding your assets. Overseas trust funds provide possession defense. On the whole, offshore counts on supply an effective device for accomplishing financial liberty and guarding your properties.

Key Strategies for Optimizing Property Security With Offshore Trusts

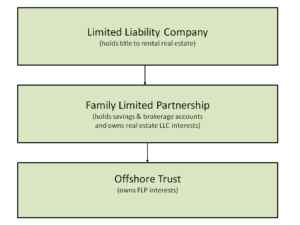

When it concerns optimizing possession security with overseas trust funds, you can employ crucial techniques to guard your wealth. One important approach is to establish the count on a territory with solid possession protection laws. By selecting a jurisdiction that has strict laws and a history of supporting count on legislations, you can make certain that your assets are well secured. Furthermore, it is crucial to thoroughly pick the trustee for your offshore trust. Choosing a respectable and credible trustee who has experience in managing overseas depends on can supply an additional layer of security for your assets. Another technique is to diversify your assets throughout numerous offshore depends on. By spreading your properties throughout different counts on, you lessen the danger of losing everything if one trust is endangered. Frequently evaluating and updating your count on documents is essential for preserving asset protection. As laws and conditions modification, it is very important to guarantee that your trust fund remains certified and reliable in safeguarding your wide range. Preserving rigorous confidentiality is critical. By keeping your offshore trust fund and its assets personal, you reduce the danger of coming to be a target for lawsuits or asset seizure. By adhering to these key approaches, you can maximize asset security with offshore trusts and protect your wealth effectively.

Checking Out the Lawful and Governing Landscape of Offshore Trust Providers

To make certain the conformity and efficiency of your overseas trust fund, it's important to stay upgraded on the governing and lawful landscape surrounding trust fund solutions. Offshore trust solutions operate within an intricate web of laws and laws, and staying notified is important for securing your assets and preserving the integrity of your depend on.

The lawful and regulative landscape of offshore trust fund services can differ dramatically from one jurisdiction to another. Different nations have different regulations governing the facility and management of counts on, along with the reporting demands and tax obligation effects related to them. These legislations can change in time, so it's essential to remain abreast of any updates or changes that might impact your trust.

Regulative bodies, such as economic services authorities or tax authorities, play a key duty in managing look what i found offshore count on services. They make sure that trustees and provider adhere to the necessary requirements and adhere to the applicable laws. Staying educated about the standards and regulations stated by these governing bodies will certainly aid you make informed choices and pick reliable solution providers for your offshore depend on.

In enhancement to nationwide regulations and laws, international arrangements and campaigns likewise affect the offshore depend on landscape. For instance, the Common Reporting Standard (CRS) requires participating countries to automatically trade economic information with other jurisdictions. Understanding the implications of such campaigns is important to make sure the compliance and effectiveness of your overseas trust.

To navigate the regulative and legal landscape surrounding overseas count on services, take into consideration looking for specialist suggestions from legal representatives or tax experts that specialize in this area. They can go to the website give you with updated details and guide you via the intricacies of the lawful structure. Keep in mind, remaining notified and proactive is crucial to making sure the long-term success and security of your offshore trust.

Navigating the Intricacies of Offshore Trusts: Tips and Finest Practices

Firstly, it's essential to collaborate with knowledgeable and reputable specialists that have a deep understanding of offshore trust funds. They can lead you with the process, aid you comprehend the regulative and legal needs, and make sure that your assets are properly safeguarded. Additionally, it is necessary to plainly specify your purposes and goals prior to developing an offshore trust fund. This will certainly assist you figure out the most appropriate structure and make certain that the trust aligns with your details demands.

Additionally, remaining updated with any kind of modifications in regulations helpful resources or policies is crucial. Offshore depends on run in a continuously progressing landscape, and recognizing any updates can assist you make educated decisions and adapt your approaches appropriately. offshore trustee. It's critical to consistently evaluate and analyze your overseas depend on to guarantee it continues to satisfy your requirements and continues to be certified with all relevant laws and policies.

Verdict

In conclusion, overseas depend on solutions can be an effective device for attaining monetary flexibility and property security. Make the most of the capacity of your riches monitoring by making use of offshore trust services to safeguard your assets and take pleasure in the benefits of monetary personal privacy.

Offshore trust fund solutions play an essential function in riches management by giving unparalleled asset defense and monetary freedom. By spreading your possessions throughout various counts on, you decrease the threat of shedding every little thing if one trust is endangered. By keeping your offshore trust and its assets confidential, you minimize the threat of becoming a target for litigation or possession seizure. By adhering to these vital approaches, you can optimize possession defense with overseas trusts and safeguard your riches properly.

Make best use of the capacity of your wealth management by using offshore trust fund services to secure your assets and appreciate the advantages of economic privacy. (offshore trustee)